[by Ssam Shah] While many people consider traditional investment sources, such as the stock market and precious metals, there is another choice that has recently gained traction even though it has been around for thousands of years. Business funding has become quite popular as a relatively quick way to turn a tidy profit while helping small and medium-sized companies in the community.

What is Business Funding?

This is providing money for businesses to make a specific purchase, such as paying for new equipment, funding a new project, or paying for an unexpected event such as repairing damage caused by a storm. This type of funding should not be confused with larger sums such as those involved with starting up a business. Instead, this type of funding is designed to meet a short-term need.

How It Works

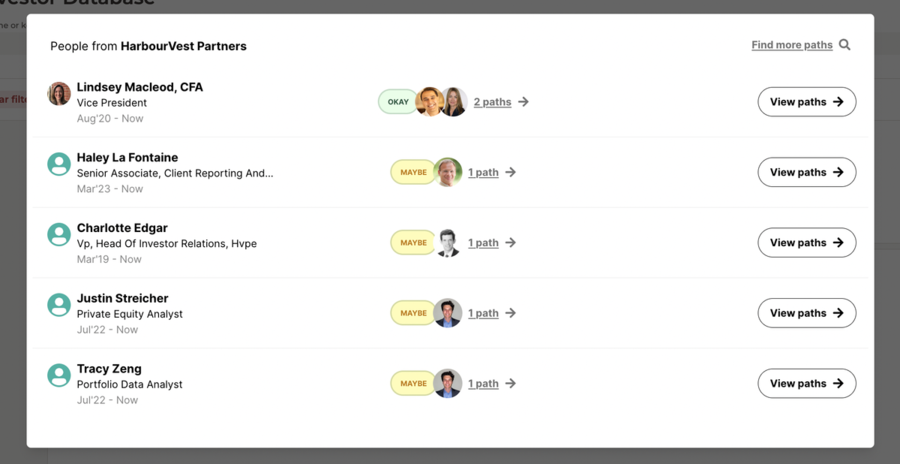

There are several ways that businesses can find the funds needed for their short-terms needs, such as from alternative finance companies, or even friends and family. However, one of the simplest and best ways for companies to find the money they need is through Angel Investors.

You can go into business funding by yourself or in combination with other funders to help local businesses get the money they need at good rates and favorable terms so they can expand, repair, or address specific issues that provide the assistance needed for them to move forward. For those who have built up a substantial amount of capital, business funding offers a relatively quick rate of return at a reasonable percentage.

Why Choose Business Funding?

There are good reasons why this form of funding has become more popular in recent years, starting with its relative ease in getting started. All you need is sufficient capital to handle the small to medium-size needs of businesses so they can address specific issues. However, there are other good reasons as well.

Fast Return: Consider that many of the projects where businesses needed this type of funding are relatively short and can be paid back in six months to a year or more depending on the terms you set. For example, supplying the funds for new equipment means you can see a healthy return of all your capital within 12 months or less.

Good Rates: You can control the interest rates so they strike the balance of being competitive while still earning you a good return. You should think about this form of funding as several smaller efforts that add up over time.

Improving the Business Community: When you make your capital available for businesses in your local area to use, you are helping to boost the economy. Buying new equipment, expanding the space available, and even addressing an unexpected expense means that businesses can now grow, add new jobs, and expand services to their customers.

So, it’s little wonder that business funding has really taken off over the past few years and for individuals who want to cash in on the trend, they can do so by themselves or as part of a small group who can pool their resources together to help their communities while making a healthy profit.

If you are interested in business funding as an option to pursue a new stream of income, Vantisco Global offers one-stop funding solutions that work for your needs.

To find out more about these funding opportunities that Vantisco Global has to offer, check out the links below:

Website: www.vantiscoglobal.com

Enquries: info@vantiscoglobal.com

Facebook: www.facebook.com/vantiscoglobal

Twitter: www.twitter.com/vantiscoglobal

Instagram: www.instagram.com/vantiscoglobal

LinkedIn: www.linkedin.com/company/11212497/