Cognitive Quant announces the general release of its unique stock screener to help investors discover high-quality companies with strong balance sheets and robust business models

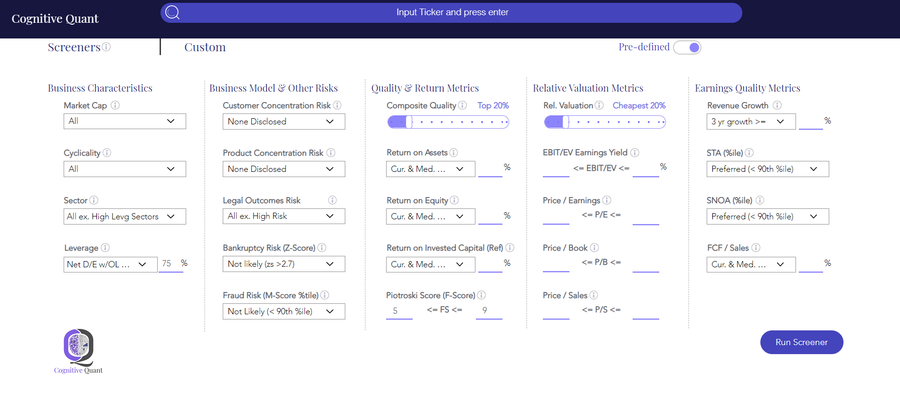

AUSTIN, TX, January 26, 2021 /24-7PressRelease/ — Cognitive Quant (https://www.cognitivequant.co), an innovative fintech startup, today announced the general release of its unique stock screener. The screener enables investors to search on both quantitative and qualitative parameters. It also enables screening based not just on the current quantitative snapshot but also on a firm’s historical record across the business cycle.

Most of the currently available screening capabilities tend to focus almost exclusively on the current quantitative metrics of a company. This recency bias can cause investors to ignore otherwise great companies that are having temporary issues and/or become lured into not so great companies that are having transitory good results.

In addition, the purely quantitative focus of current screeners can cause investors to ignore important qualitative risks such as from legal proceedings, or from customer, product, and supplier concentration risks, among other qualitative risks. The past few years have not been kind to systematic value investing – partly because no strategy works all the time, and in our view, in part, also because algorithms are becoming better at assessing qualitative risks.

“Cognitive Quant is utilizing Artificial Intelligence, Natural Language Processing, and advances in business reporting to provide qualitative risk assessments and help nudge investors to pay closer attention to these risks,” said Teji Abraham, Founder & CEO of Cognitive Quant. These insights have been incorporated into the screener to help investors discover high-quality companies with strong balance sheets and robust business models.

Cognitive Quant platform also features a distinctive user experience that has been carefully designed by leveraging insights from behavioral science to help investors take a more attentive and deliberative investment approach and enable rational investment decisions.

Learn more about Cognitive Quant at https://www.cognitivequant.co/about

About Cognitive Quant

Cognitive Quant platform brings together behavioral science, natural language processing, and artificial intelligence to help investors overcome cognitive biases, deliver unique risk insights, and enable rational investment decisions.

The platform features:

– Behavioral Science-driven UX Design to help overcome cognitive biases

– AI & NLP-enabled Stock Screener incorporating both quantitative and qualitative parameters

– Unique Risk Insights leveraging AI, NLP, and XBRL (open international standard for digital business reporting)

– Fundamental Sentiments to surface qualitative risks buried in lengthy SEC filings

– Valuation Tools, Investment Checklist, Recent News, SEC Filings, and more

—

For the original version of this press release, please visit 24-7PressRelease.com here