As many business owners seek finance to help support them through the current COVID-19 outbreak, Liberty says that a custom business loan could be the answer that SMEs are looking for.

MELBOURNE, AUSTRALIA, February 18, 2022 /24-7PressRelease/ — While there are a range of Government support options available to those who have been adversely affected, not all businesses meet the necessary criteria. However, lenders like Liberty can tailor a solution to suit customers’ unique business needs.

According to Head of Consumer Communications Heidi Armstrong, the non-bank can provide business loan solutions that customers may not have been aware of, offering greater freedom and choice.

“Whether you have a young start-up or an established business, fast access to funds can be essential to your success – especially during these challenging times. Liberty understands this, which is why we’ve created such a diverse and flexible product offering.”

With specialist credit assessment practices and decades of experience in the custom lending space, Liberty assesses each application on a case-by-case basis.

This more personalised approach allows the lender to provide tailored solutions suited to the needs of each borrower. It also supports them to help those with lower credit scores who may have found it difficult to secure a business loan in the past.

As one of the first non-banks to join the Government’s SME Recovery Loan Scheme, Liberty recognised the need for more options and greater support. The lender was quick to refine their already wide range of business loan options, introducing two new loan options, as well as a line of credit.

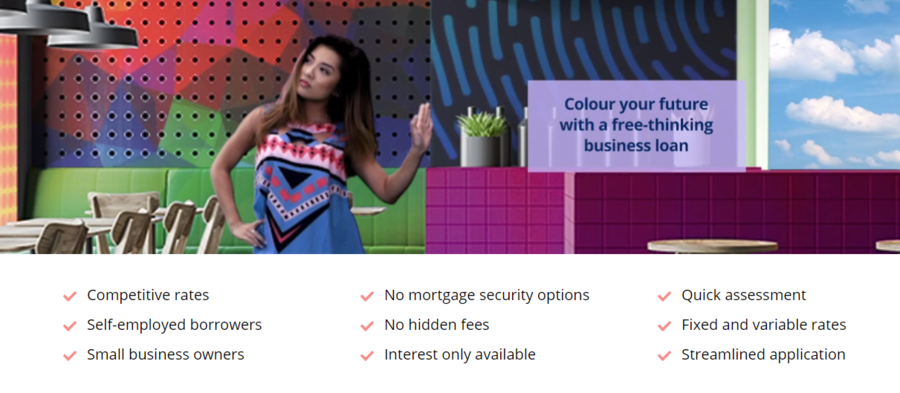

Liberty also offers interest-only options and business loans with no mortgage security required. And, with flexible assessments and fast turnaround times, Liberty is well-equipped to support business customers to gain fast access to funds when required.

For further support to navigate the lending process, a Liberty Adviser can provide expert guidance and support business customers to explore their options.

Approved applicants only. Lending criteria apply. Fees and charges are payable. Liberty Financial Pty Ltd ACN 077 248 983 and Secure Funding Pty Ltd ABN 25 081 982 872 Australian Credit Licence 388133, together trading as Liberty Financial.

Contact

Heidi Armstrong

Group Manager – Consumer Communications

P: +61 3 8635 8888

E: mediaenquiries@liberty.com.au

—

For the original version of this press release, please visit 24-7PressRelease.com here